Introduction

How to Build a Career Kotak NextGen Program- 2025 In today’s competitive banking sector, securing a strong foothold requires more than just a degree—it demands specialized training, industry exposure, and hands-on experience. Kotak Mahindra Bank’s NextGen Program, designed in collaboration with Manipal Academy of BFSI & ITM Skills University offers a unique pathway for aspiring bankers to fast-track their careers.

This program is not just another training course; it’s a career-launching platform that combines classroom learning, internships, and job placements at one of India’s leading private banks. But how do you make the most of it? What skills do you need? And what does the selection process look like? (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

In this comprehensive guide, we’ll break down everything you need to know about the Kotak Mahindra NextGen Program, from eligibility , selection Process, Fees to career growth post-completion.

One-year skill-based learning for Direct Entry into the Bank

Kotak Mahindra Bank’s NextGen Bankers Programme in association with Manipal Academy of BFSI & ITM Skills University is a cutting-edge Direct Entry initiative designed to foster emerging talent in the banking industry. This programme offers an assured promising career pathway within Kotak Mahindra Bank Ltd.

1. Understanding the Kotak Mahindra NextGen Program (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

What Is the NextGen Program?

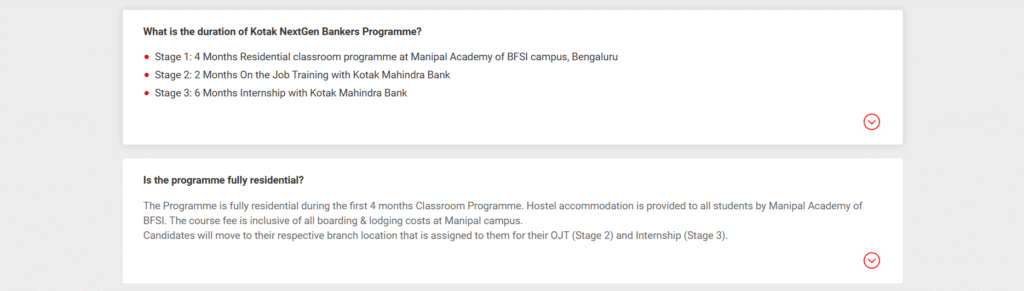

The NextGen Program is a 12-month training initiative where candidates undergo:

- 4 – months of classroom training (covering banking fundamentals, sales, operations, and digital banking)

- 2 – month On-the-Job Training of banking functions In Kotak Mahindra Bank

- 6 – month internship at an allocated branch/office

Upon successful completion, candidates are absorbed as full-time employees in roles such as Branch Relationship Manager (Deputy Manager). (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

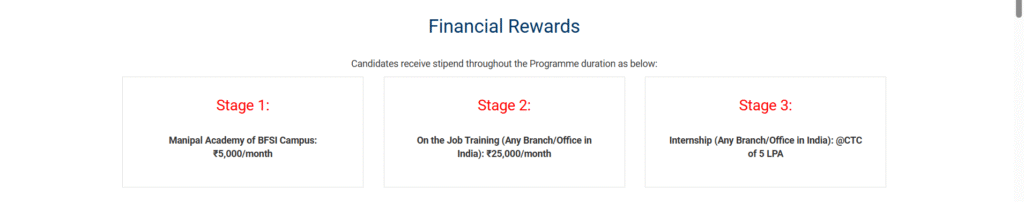

Financial Rewards

Stage 1: 4- Months of classroom training Manipal Academy of BFSI Campus: ₹5,000/month

Stage 2: 2 – Month On the Job Training (Any Branch/Office in India): ₹25,000/month

Stage 3: 6 – Month Internship (Any Branch/Office in India): @CTC

of 5 LPA

Why Choose This Program?

- Guaranteed Job Placement: Unlike generic, NextGen ensures employment with Kotak.

- Industry-Relevant Curriculum: Designed by banking experts and Manipal Academy of BFSI & ITM Skills University

- Earn While You Learn: Stipend during internship phase.

- Fast-Track Growth: Kotak prioritizes NextGen graduates for promotions. (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

यह भी पढे:

1. HDFC Future Banker Program joining worth or not-2025

2. HDFC Future Banker me career kaise banaye? 2025

3. 5 Best High-Paying Skills to Learn in 2025

If you are also not able to crack the Private bank & Company exam & Interview then join this institute today / Click here-TSH Institute

2. Eligibility and Selection Process

Who Can Apply?

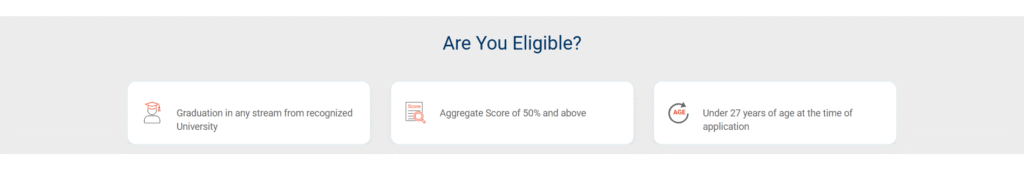

The program is open to:

- Fresh graduates (Graduation in any stream from recognized University)

- Age limit: (Under 27 years of age at the time of application)

- Score: (Aggregate Score of 50% and above)

Selection Process Breakdown

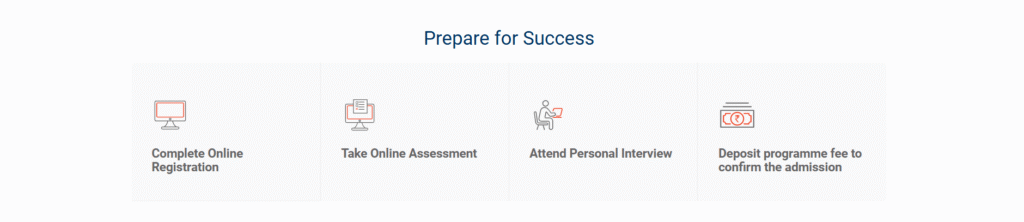

The selection involves multiple stages:

Stage 1: Online Application

- Fill out the form on Kotak/Manipal’s website.

- Ensure your resume highlights communication skills, academics, and extracurriculars.

Stage 2: Online Aptitude Test

- Tests quantitative ability, logical reasoning, and English proficiency.

Stage 3: Personal Interview

- Questions on banking awareness, career goals, and situational judgment.

- Example: “How would you handle an unhappy customer?” (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

Stage 4: Final Offer

- Selected candidates receive an admission letter from Manipal Academy of BFSI & ITM Skills University.

Table of Contents

3. What to Expect During Training?

Phase 1: Classroom Learning (4 Months)

Held at Manipal Academy of BFSI & ITM Skills University, the curriculum includes: (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

- Banking Fundamentals (Retail Banking, Loans, Investments)

- Sales & Customer Relationship Management

- Digital Banking & Fintech Trends

- Soft Skills & Business Communication

Grading System:

- Regular exams, assignments, and presentations.

Phase 2: On the Job Training (2 Months)

- Stipend: ₹25,000 per month (varies yearly).

- Roles: Assisting in branch operations, customer onboarding, lead generation.

- Performance Metrics: Sales targets, customer feedback, attendance.

Phase 3: Internship (6 Months)

- Internship (Any Branch/Office in India): @CTC

of 5 LPA

Programme Fee

₹2,80,000 (Loan facility available)

(inclusive of all taxes, boarding, lodging, android tablet and health insurance) (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

Pro Tip:

- Treat the internship as a probation period—your full-time role depends on performance.

4. Career Pathways After NextGen (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

Job Roles Offered

Successful candidates are typically placed in:

- Branch Relationship Manager (Deputy Manager). (Sales & Client Acquisition)

Salary Structure

- Starting salary: ₹5 LPA (varies by location & role).

Growth Opportunities

- Vertical Growth: Assistant Manager → Branch Manager → Regional Head.

- Horizontal Growth: Moving to departments like Digital Banking, Corporate Sales, or Risk Management. (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

Real-Life Example:

- Priya Sharma (NextGen 2020 batch) started as a Relationship Manager and became Assistant Branch Manager in 2.5 years due to high sales performance. (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

5. How to Excel in the NextGen Program?

Skills to Develop

- Sales & Persuasion: Banking is target-driven.

- Customer Service: Handling queries professionally.

- Digital Literacy: Understanding UPI, mobile banking, AI in finance.

Networking Tips

- Build relationships with seniors, trainers, and branch managers—they influence placements.

- Join Kotak’s internal employee groups on LinkedIn.

Avoiding Common Mistakes

- Neglecting Internship Performance: Some take it lightly and lose job offers.

- Ignoring Industry Trends: Keep up with RBI policies, new fintech tools. (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

6. Is the NextGen Program Right for You?

Pros

✔ Structured career entry into banking.

✔ Faster growth than traditional bank jobs.

✔ Strong brand value (Kotak + Manipal).

Cons

✖ Rigorous training—not for those seeking a relaxed job.

✖ Sales pressure in some roles.

Best Suited For:

- Freshers who want a stable banking career without an MBA.

- Those comfortable with target-driven roles.

Conclusion: Your Next Steps

The Kotak Mahindra NextGen Program is a golden opportunity for anyone serious about a banking career. With a blend of education and hands-on experience, it eliminates the usual struggle of job hunting post-graduation.

Action Plan:

- Check Eligibility – Ensure you meet criteria.

- Prepare for Exams – Brush up on aptitude and banking terms.

- Ace the Interview – Show enthusiasm for sales & customer service.

- Give 100% in Training – Your internship performance decides your job.

If you’re ready to work hard and build a long-term career in banking, the NextGen Program could be your perfect launchpad.

Final Thought

“Banking is a people’s business. The NextGen Program doesn’t just teach banking—it teaches you how to thrive in it.” – Senior Kotak HR Manager.

Would you consider applying? Let us know in the comments!

1. What is the Kotak NextGen Bankers Program?

The first 4 months of the programme is of a fully residential classroom programme. The classroom programme shall be conducted on the ITM Campus location. In the next 8 months, NextGen Bankers will undertake 2 months On-the-Job Training (OJT) and 6 months Internship. (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

2. What is the salary of Kotak Bank Next Generation Program?

All candidates are paid a stipend throughout the 12 month programme. The details are as below: Stage 1 (Month 1 – 4): Manipal Academy of BFSI, Bengaluru – INR 5,000/Month. Stage 2 (Month 5 – 6): On the Job Training (OJT) – INR 25,000/Month.

3. कोटक नेक्स्ट जनरेशन प्रोग्राम की सैलरी कितनी है?

सभी उम्मीदवारों को 12 महीने के कार्यक्रम के दौरान वजीफा दिया जाता है। विवरण नीचे दिए गए हैं: चरण 1 (महीना 1 – 4): मणिपाल अकादमी ऑफ बीएफएसआई, बेंगलुरु – 5,000 रुपये/महीना । चरण 2 (महीना 5 – 6): ऑन द जॉब ट्रेनिंग (ओजेटी) – 25,000 रुपये/महीना । (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

4. Is Kotak Mahindra Bank a good job?

Kotak Mahindra Bank generally receives positive ratings from employees regarding career opportunities and the overall working environment, with a strong emphasis on growth and development. However, some employee reviews also mention areas for improvement, such as work-life balance and certain aspects of management.

5. Which bank job has highest salary?

In the banking sector, Investment Banker, Fund Manager, and Chief Executive Officer (CEO) typically have the highest salaries. These roles involve high-level decision-making, risk management, and capital management. Other high-paying positions include Finance Manager, Financial Analyst, Credit Analyst, and Foreign Exchange Trader, as well as roles like Branch Manager and Chief Financial Officer (CFO). (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

6. कोटक बैंक का मालिक कौन है?

उदय कोटक बैंक के संस्थापक और निदेशक हैं। गैर-कार्यकारी निदेशक बनने से पहले वे सितंबर 2023 तक बैंक के प्रबंध निदेशक और सीईओ थे। उन्होंने पिछले 38 वर्षों में कोटक महिंद्रा समूह के विकास में महत्वपूर्ण भूमिका निभाई है।

7. What is nextgen banking?

A defining characteristic of next-gen banking is being fully digital, and that means more digital channels, more customer touchpoints, and unfortunately, more digital threats. Globally, payment card fraud cost businesses $33.8 billion in 2023. ( Nilson Report) (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

8. Who is eligible for HDFC Future bankers Program?

To be eligible for the HDFC Future Bankers Program, candidates typically need a full-time bachelor’s degree from a recognized university. They should be between 21 and 28 years old. Additionally, they should not have any relatives working at HDFC Bank or in the program itself, and there should be no pending legal cases. Candidates who are currently employed with HDFC Bank or its subsidiaries are also ineligible. (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

9. What is the probation period of Kotak bank?

Probation – Your appointment is subject to a probation period of 12 Months. Permanent placement with us is contingent upon your successful completion of the probation. During this period, your employment may be terminated by the Bank or by yourself by giving 1 months’ notice to the other. (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)

10. आप कोटक महिंद्रा बैंक से क्यों जुड़ना चाहते हैं?

व्यावसायिक लहज़ा :- मुझे kotak.com में काम करने में दिलचस्पी है क्योंकि यह भारत में एक अग्रणी वित्तीय सेवा कंपनी है। मैं एक पेशेवर माहौल में काम करना चाहता हूँ जहाँ मैं कंपनी की सफलता में योगदान देने के लिए अपने कौशल और ज्ञान का उपयोग कर सकूँ। (How to Build a Career Kotak NextGen Program – Are you getting an answer to this)